1099 R Where To Download From Wells Fargo

Establishing secure connection… Loading editor… Preparing document…

- Electronic Signature

- Forms Library

- Other Forms

- All Forms

- Get and Sign Federal ID Number on 1099 Sa Form

Get and Sign Federal ID Number on 1099 Sa Form

Use a wells fargo 1099 template to make your document workflow more streamlined.

How it works

Upload the 1099 int wells fargo

Edit & sign 1099 sa from anywhere

Save your changes and share 1099 sa federal id number

Rate the form 1099 sa

Quick guide on how to complete wells fargo 1099 int

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow's web-based program is specifically developed to simplify the arrangement of workflow and improve the whole process of qualified document management. Use this step-by-step instruction to fill out the Wells fargo 1099 sa form promptly and with ideal precision.

Tips on how to fill out the Wells fargo 1099 sa form on the web:

- To begin the document, utilize the Fill & Sign Online button or tick the preview image of the blank.

- The advanced tools of the editor will lead you through the editable PDF template.

- Enter your official identification and contact details.

- Use a check mark to indicate the answer wherever required.

- Double check all the fillable fields to ensure full precision.

- Make use of the Sign Tool to create and add your electronic signature to signNow the Wells fargo 1099 sa form.

- Press Done after you complete the form.

- Now you'll be able to print, download, or share the document.

- Refer to the Support section or contact our Support staff in case you have any questions.

By utilizing SignNow's comprehensive platform, you're able to execute any necessary edits to Wells fargo 1099 sa form, generate your personalized electronic signature in a couple of quick steps, and streamline your workflow without the need of leaving your browser.

be ready to get more

Create this form in 5 minutes or less

How do i get my 1099 form from wells fargo

Find a suitable template on the Internet. Read all the field labels carefully. Start filling out the blanks according to the instructions:

Instructions and help about wells fargo 1099 r

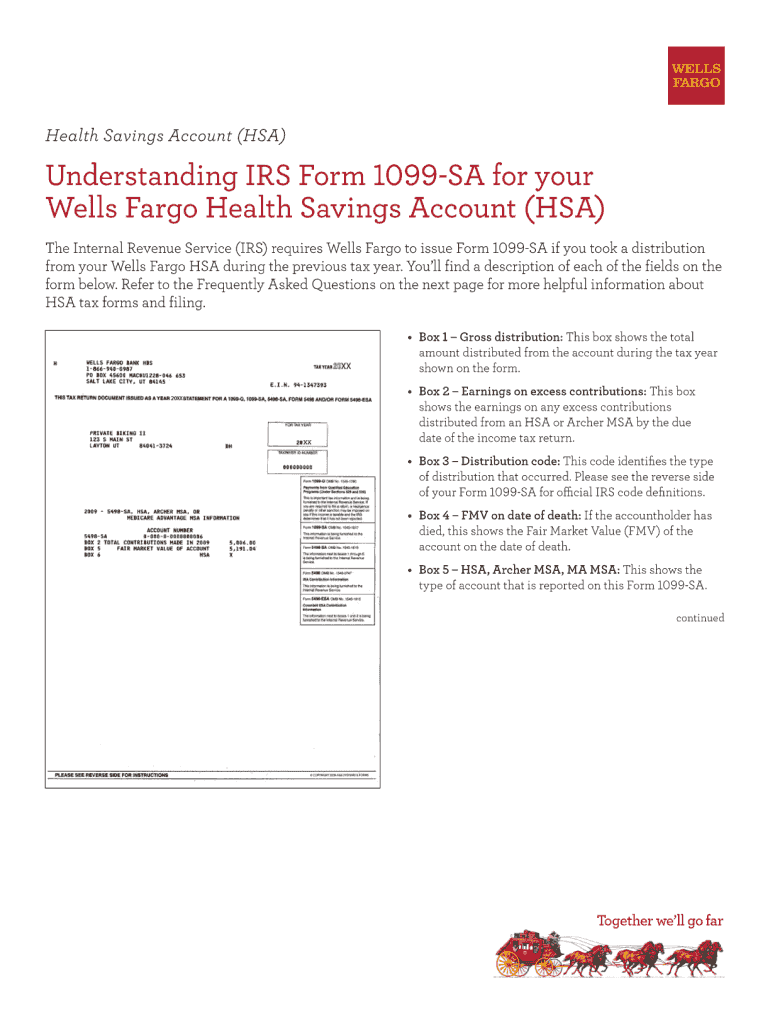

what is a 1099 s a tax form updated for tax year 2016 when you use the funds from a health savings account HSA or a medical savings account MSA such as an archer MSA say the institution that administers the account must report all distributions on form 1099 ese

FAQs

Here is a list of the most common customer questions. If you can't find an answer to your question, please don't hesitate to reach out to us.

Need help? Contact support

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of "miscellaneous" income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it's hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you'd have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I'm sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you're asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you're someone who's responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It's basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You'll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

Do you need to fill I-9 form for 1099 contract?

There's no such thing as a "1099 employee." You are either an employee or you are not. The IRS rules are here Independent Contractor Self Employed or Employee and ICE uses a similar process to determine who is an employee and who is not.While it is illegal to retain a contractor whom you know to be working illegally, you are not required to connect Form I-9 from your independent contractors. You may do so if you wish.Who Needs Form I-9? Explains who must provide Form I-9.

-

I just received a 1099-K form from Coinbase? How do I fill my taxes?

1099-Ks from Coinbase, Gemini, and other exchanges only show your CUMULATIVE transaction value. That's why the amount may seem HUGE if you swing traded your entire balance multiple times.However you only need to pay taxes on your capital gains/losses, so that amount is likely less than the 1099K's amount. You need to file a Schedule D 1040 with a 8949.I recommend checking out Crypto tax sites like TokenTax that calculate all of that for you — Here is an article about 1099Ks from them - Coinbase Pro sent me a 1099-K. What do I do now? | TokenTax Blog

-

How do I find out if wells Fargo opened an account in my name?

In order to ensure that you are not a victim of the phony account scandal, the basic thing you can do is:Go through your monthly statements, look at the fees you have been charged, and any other charges for that matter. See if there are charges for a product or service you have not signet for.Login to your account, see what products and services are assigned to you. See if there is some product or services you should not have.Go to a Wells Fargo branch (other than the one you are constantly going), ask from the employee to give you a list of all products you have with the bank. See if their is something that you didn't apply for.When doing this, look primarily at your deposit accounts as well as credit card accounts. See if you were paying any fees for this type of accounts. If yes, see if you have signed up for these accounts. Maybe, one of the reason that have resulted in the possibility for the phony accounts scandal is that we do not control what are we being charged for by the banks.

-

How do I print out my Form 1099 from SSA?

I fill in the Form 1099 and immediately print it here: http://bit.ly/2Nkf48f

Related searches to Federal Id Number On 1099 Sa

fidelity 1099-sa federal id number

federal id number 1099-r

1099-sa account number

did not receive 1099-sa

where do i enter form 1099-sa

the corrected box is checked on this 1099-sa

hsa federal id number same as tin

5498-sa

Create this form in 5 minutes!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

How to create an eSignature for the wells fargo 1099 sa form

Speed up your business's document workflow by creating the professional online forms and legally-binding electronic signatures.

How to make an eSignature for the Wells Fargo 1099 Sa Form online

How to make an electronic signature for the Wells Fargo 1099 Sa Form in Google Chrome

How to create an electronic signature for putting it on the Wells Fargo 1099 Sa Form in Gmail

How to generate an eSignature for the Wells Fargo 1099 Sa Form right from your mobile device

How to create an eSignature for the Wells Fargo 1099 Sa Form on iOS devices

How to create an electronic signature for the Wells Fargo 1099 Sa Form on Android devices

Related links to Federal Id Number On 1099 Sa

People also ask

-

How do I get my HSA tax form?

IRS Form 1040: Individual Income Tax Return. You'll need to use the 1040 long form to help file your HSA. ... IRS Form 5498-SA: Total HSA Contributions. ... IRS Form 1099-SA: Total HSA Distributions. ... IRS Form W-2: Wage and Tax Statement. ... IRS Form 5329: Excess HSA Contributions.

-

Do I need to report HSA contributions on my tax return?

When you file, you'll need to include Form 8889 to report all contributions and withdrawals associated with your HSA in 2013. The form has a line for reporting your direct contributions to your HSA, and you'll carry that deduction to line 25 of your Form 1040.

-

Where do I find my HSA contributions on my w2?

You must report all employer contributions (including an employee's contributions through a cafeteria plan) to an HSA in box 12 of Form W-2 with code W. Employer contributions to an HSA that are not excludable from the income of the employee also must be reported in boxes 1, 3, and 5.

-

Where can I get my 1099 SA form?

Q. When will I get my tax forms? A. IRS Form 1099-SA is typically available at the end of January. It will be posted to your account and mailed, if elected. IRS Form 8889 can be downloaded from IRS.gov at any time.

-

How does a HSA affect my tax return?

The money deposited into the HSA is not subject to federal income tax at the time of the deposit is made. Additionally, HSA funds will accumulate year-to-year if the money is not spent. HSA funds may be used to pay for qualified medical expenses at any time. ... The interest earned on the account is tax-free.

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.

Posted by: antonykleidon.blogspot.com

Source: https://www.signnow.com/fill-and-sign-pdf-form/686-wells-fargo-1099-sa-form